The Obama-era Consideration of Deferred Action for Childhood Arrivals (DACA) program has been through a roller-coaster ride of ups and downs recently. On June 15, 2020, the Department of Homeland Security (DHS) released a memorandum regarding DACA (“first memorandum”). However, when the Supreme Court released its decision in the lawsuit Trump v. NAACP, No. 18-588 on June 18, 2020 to prevent the end of the DACA program, DHS had to update its policy. The updated memorandum was released on July 28, 2020 (“second memorandum”) abides by the Supreme Courts decision to prevent the end of the DACA program. At this point, there were still questions on how DACA applications will be handled.

On August 21, 2020, the United States Citizenship and Immigration Services (USCIS) released a policy guidance on how the agency will adjudicate DACA applications and associated work permit applications based on the second memorandum. In this post, we highlight the key points of the current DACA policy guidance based on commonly asked questions.

Will all DACA applications and work permit applications be denied?

The second memorandum applies to “initial” DACA applications and its associated employment applications (I-765). If you’ve already been granted DACA at some point, then your application is not an “initial” application. If you’ve never been granted DACA, then your DACA application will be automatically rejected. It does not matter if you filed the application before the release of the first or second memorandum. If you do not have an approval, then your application was “pending”, and thus it will be rejected.

Rejected applications will not be reviewed at all, so USCIS will refund the application fees.

If your application is rejected, it will not affect your chances at reapplying. If there any changes to the DACA situation, and your able to reapply, the rejected application will not count against you.

What if I had DACA, but I didn’t renew it before it expired?

A key difference between the first memorandum and the second memorandum is how USCIS processes DACA applications with expired status. Before the memorandum, USCIS allowed reapplications for DACA recipients with expires statuses up to one year. The first memorandum would have changed this, but the second memorandum upholds the previous adjudication method.

In sum, you have one year to renew your DACA after its expired.

Should I file my DACA renewal even though I still have time?

Although the official recommendation has been to file DACA renewals 150 days or less before its due, many have attempted to file early in hopes of extending their DACA before the program ends. However, the second memorandum states that USCIS has not been processing DACA renewal applications that have more than 150 days left. Instead, USCIS has placed such applications in “pending” status.

From now on, USCIS will reject any DACA renewal application that is filed more than 150 days before its expiration, unless there is a valid reason for the renewal. In other words, there is no point in submitting an early renewal unless you have a very good reason.

Will my DACA status be shortened from two years to one year?

If you currently have DACA status, the second memorandum will not “shorten” the duration of your status. However, when you apply to renew your status, you will find that USCIS only grants one year extension at a time.

Employment Authorization Document (EAD), or work permits, will also be renewed for one year at a time.

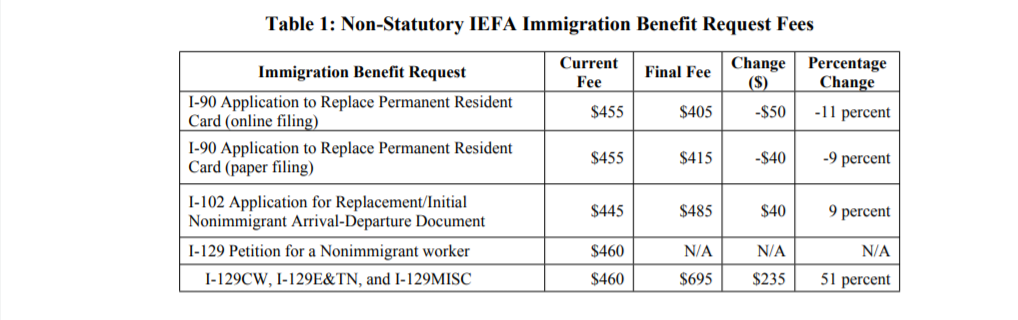

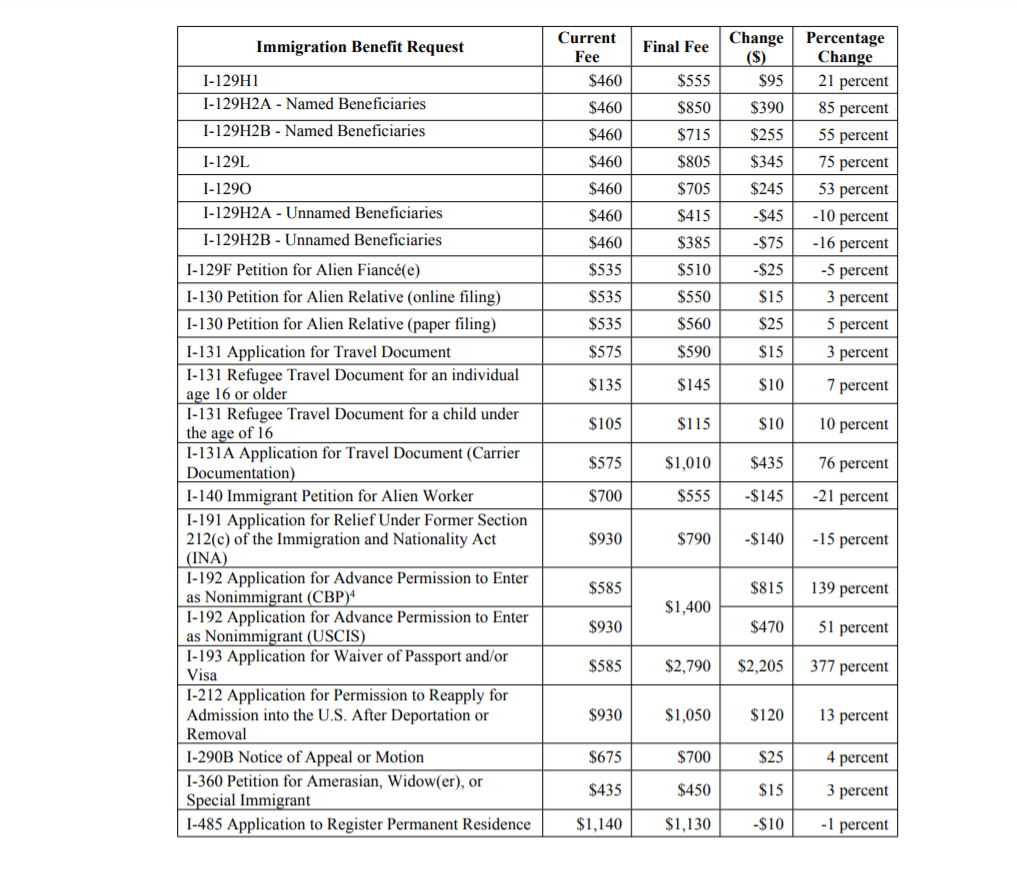

Will I have to pay more if I renew after October 2nd, 2020?

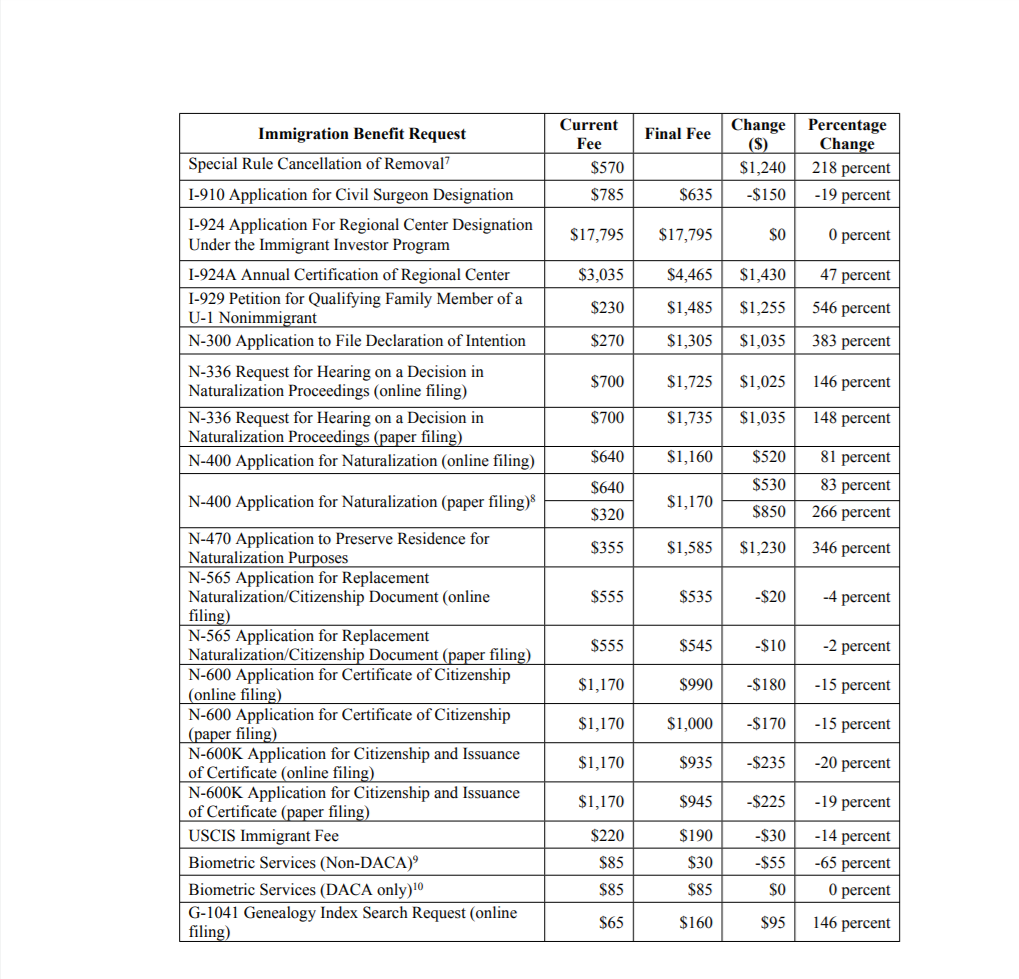

Recently, USCIS announced it will increase certain application and petition fees starting from October 2nd, 2020. The EAD renewal and biometrics fees will not increase for DACA renewal applicants.

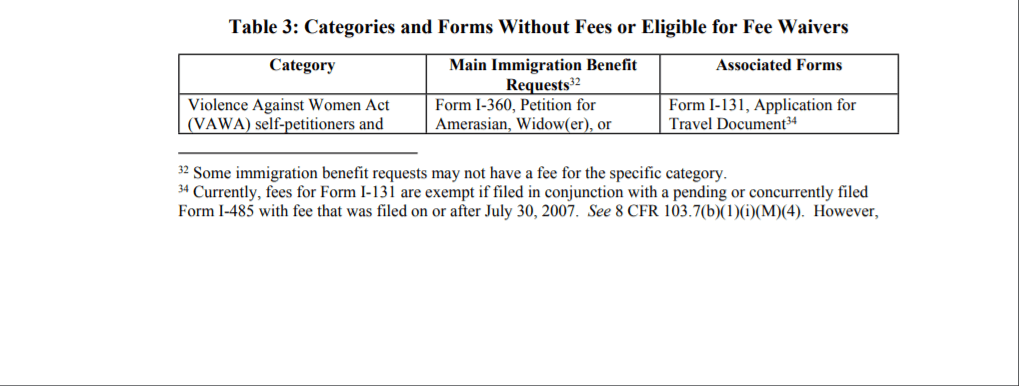

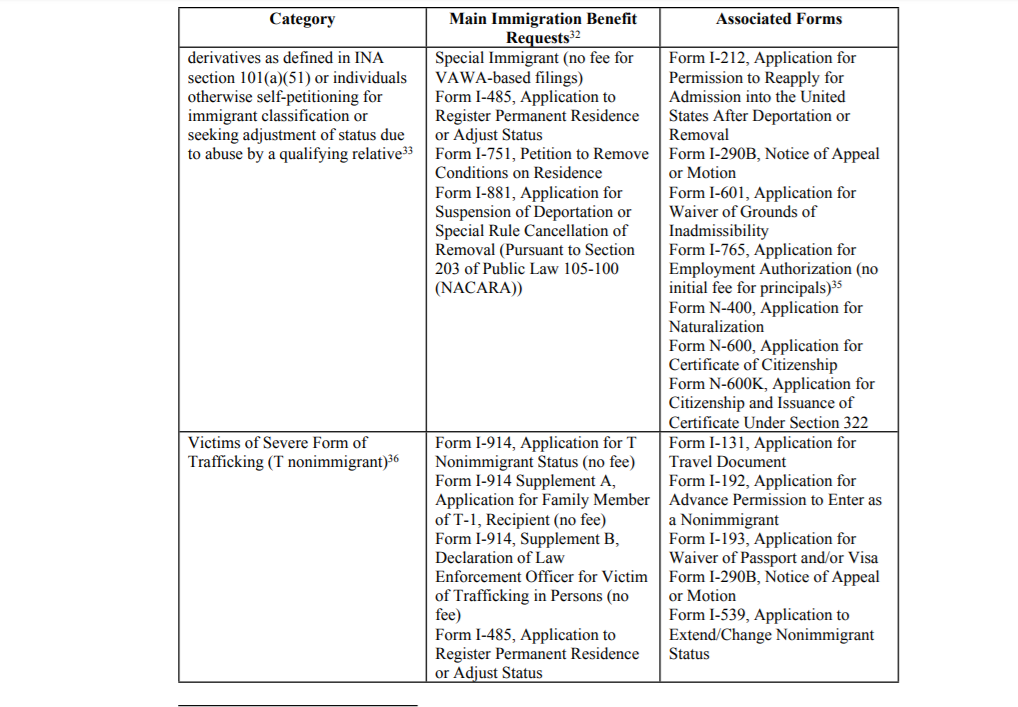

Can I apply for a Travel Document (Advanced Parole)?

The short answer to this is “no”. However, it can depend on your circumstances.

The second memorandum states that any Advanced Parole (Form I-131) filed before July 24, 2020 will be rejected. USCIS will refund all I-131 application fees. Applicants are allowed to reapply, but the form instructions have changed on the USCIS website.

If you have DACA, but you also have another pending immigration benefit, such as a permanent residence application (Form I-485) pending, then you can apply for advanced parole using the requirements associated with that immigration benefit.

Otherwise, the second memorandum states that DACA holders can only apply for advanced parole under “exceptional circumstances”. It even goes further to specify what is not an exceptional circumstance:

- Traveling abroad to visit family and friends

- Going on a vacation

- Traveling abroad for educational purposes

- Traveling abroad for work purposes

So what is considered an “exceptional circumstance” that would allow a DACA holder to receive a travel document for traveling out of the country? The second memorandum offers a few examples:

- Travel to obtain life-sustaining medical treatment that is not available in the U.S.

- Travel to support the immediate safety, well-being, or care of an immediate relative, such as a minor.

- Travel in the interest of U.S. national security or interests.

Finally, the memorandum states that if you’ve already been granted advanced parole, it will not be cancelled because of the memorandum.

Are you a current DACA holder with questions regarding status renewal or your work permit? Contact us for how we can help you with your situation. Or are there questions that were not answered in this post? Comment them below!